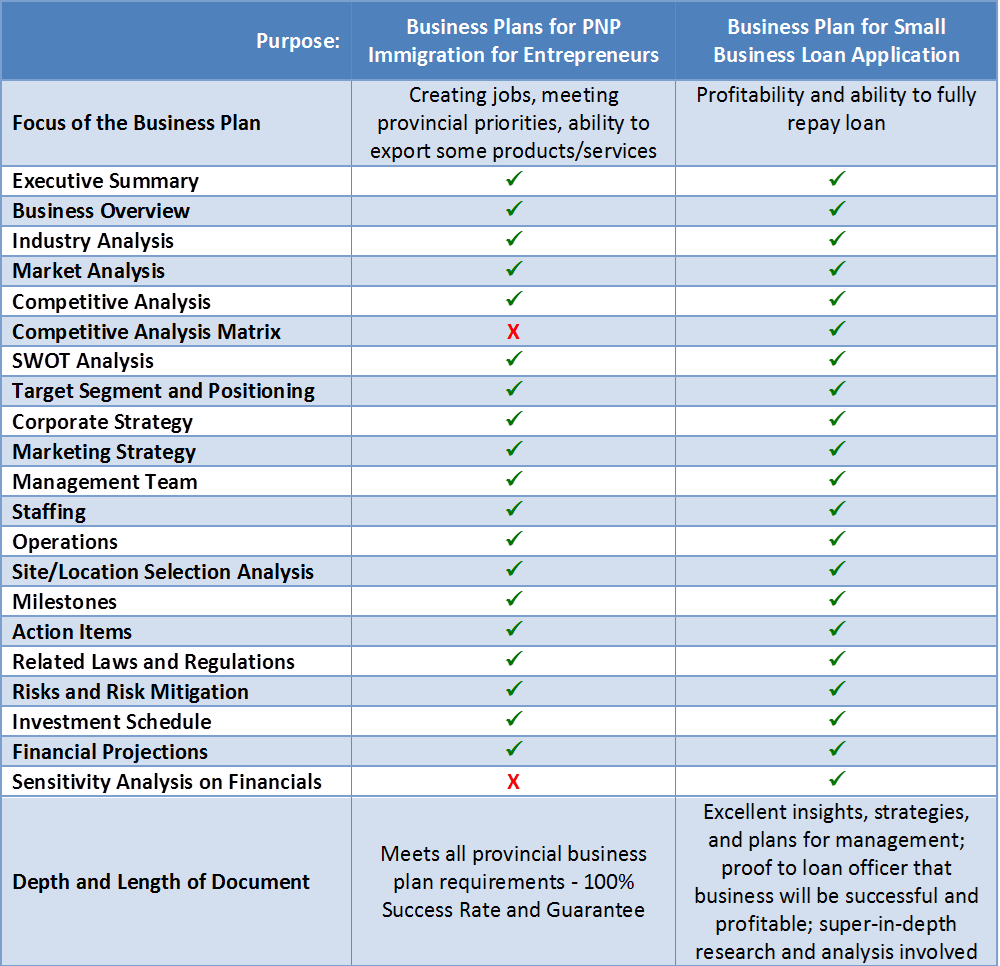

The business plan and loan proposal has a dual purpose: to give the CPA a clear, strategic vision for directing day-to-day operations and to assist in obtaining financing Feb 25, · The kind of business plan you need to write when applying for a loan will vary depending on your business and your financing goals. Business plan types include: Business plan for a startup business: When you need a loan to get a new business off the ground, a well-written startup business plan can help persuade lenders you've got what it takes to succeed. 7 (a) loans are the most basic and most used type loan of the Small Business Administration's (SBA) business loan programs. Its name comes from section 7 (a) of the Small Business Act, which authorizes the agency to provide business loans to American small businesses

SBA Recommended Business Plans & Length | The U.S. Small Business Administration | blogger.com

View coronavirus COVID resources on GovLoans. Visit Coronavirus. gov for live updates. The Small Business Administration's SBA disaster loans are the primary form of Federal assistance for the repair and rebuilding of non-farm, private sector disaster losses. The disaster loan program is the only form of SBA assistance not limited to small businesses.

The purpose of the program is to help Indian-owned businesses obtain commercially-reasonable financing from private sources. The Division of Capital Investment manages the Indian Loan Guaranty, Insurance, and Interest Subsidy Program which breaks through the conventional barriers to financing for tribes and individual Indians.

The loan program helps…. Its name comes from section 7 a of the Small Business Act, which authorizes the agency to provide business loans to American small businesses.

The loan program is designed to assist for-profit businesses that are not able to get…. The Program provides growing businesses with long-term, fixed-rate financing for major fixed assets, business plan loans, such as equipment or real estate. The MicroLoan Program provides very small loans to start-up, newly established, or growing small business concerns and certain not-for-profit childcare centers.

Under this program, SBA makes funds available to nonprofit community based lenders Microlender Intermediaries which, business plan loans, in turn, make loans to eligible borrowers in amounts up to a maximum of…. The purpose of the Military Reservist Economic Injury Disaster Loan program MREIDL is to provide funds to eligible small businesses to meet its ordinary and necessary operating expenses that it could have met, but is unable to meet, because an essential employee was "called-up" to active duty in their role as a military reservist.

These loans are…. This purpose is achieved by business plan loans the existing private credit structure through the guarantee of quality loans which will business plan loans. If you are in a declared disaster area and have experienced damage to your business, you may be business plan loans for financial assistance from the Small Business Administration SBA.

Businesses of any size and most private nonprofit organizations may apply to the SBA for a loan to recover after a disaster. Business Loans. Economic Injury Disaster Loans.

Indian Loan Guaranty, business plan loans, Insurance, and Interest Subsidy Program. Certified Development Company CDC Loan Program.

Microloan Program. Military Reservist Economic Injury Disaster Loan Program. Equity Investment - Small Business Investment Company SBIC Program. Business and Industrial Loans, business plan loans. Fisheries Finance Program. Business Physical Disaster Loans. Choose up to 3 loans to compare, business plan loans. Compare Clear Selection. Back to Loan Categories.

9 Startup Funding Options - Business Loans + More

, time: 6:43How to Make a Business Plan for a Loan - Experian

Aug 27, · Writing a business plan for a loan, also known as a loan proposal, involves anticipating and detailing a business’s potential financial needs well in advance of when the loan is needed. This plan, along with any necessary documentation from your lender, is used to apply for a small business loan and can factor heavily on getting approved for the blogger.comted Reading Time: 7 mins Writing a business plan is very crucial when you are planning to start a loan company. A plan would persuade investors to finance your business, aside that, a business plan gives you a clear overview of your loan company. A basic business plan The business plan and loan proposal has a dual purpose: to give the CPA a clear, strategic vision for directing day-to-day operations and to assist in obtaining financing

No comments:

Post a Comment